(13 April 2022) As Ulster Bank and KBC Bank Ireland prepare to exit the Irish market, Age Action is calling for a transparent process to be initiated across all the banks, which allows customers the opportunity to switch their accounts in a timely manner with the appropriate level of support and staffing levels to meet customers’ expectations.

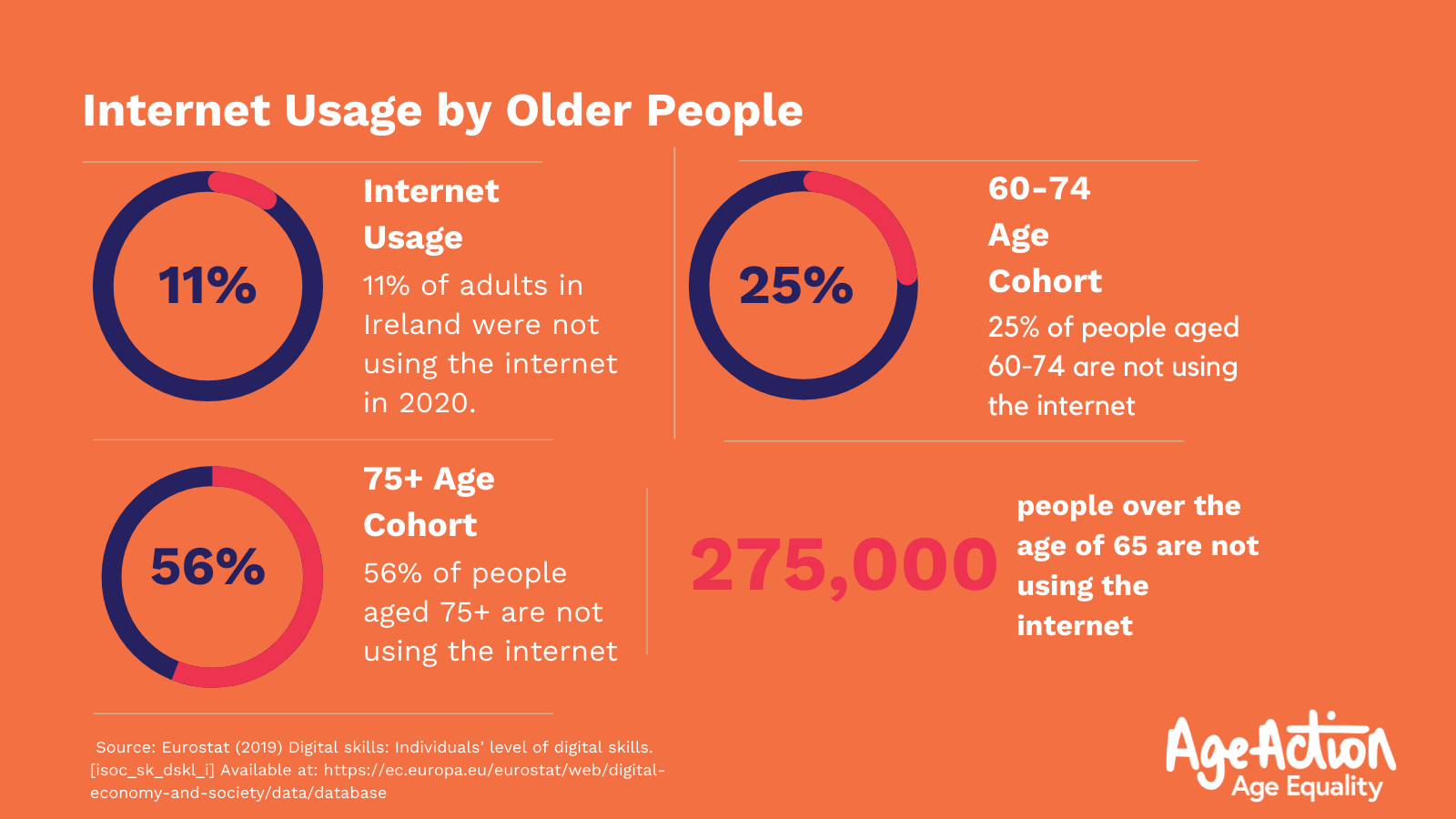

We know from our work that access to financial services is critical to supporting people to age in place. With the closure of bank branches some older people have very limited access to banks due to lack of access to transport. For those who are digitally excluded the situation is particularly difficult. 275,000 people over the age of 65 are not using the internet for a variety of reasons and hundreds of thousands of others are counted as 'online' but lack the basic skills required to allow them to make use the internet safely, including to conduct their financial affairs.

A lack of access to financial services, including cash and credit puts people at risk of financial abuse, fraud and ultimately undermines people's independence and autonomy.

We also know from our work that switching bank accounts is not as easy as is suggested by banks. Issues that people have identified include:

- Proof of identity – some people are finding this a challenge because they don’t have valid passports or driving licences, particularly those who are resident in long term care. There is a need for some clarity about how people can be accommodated in this situation.

- Proof of address – this is a challenge for people who are living in long term care or with someone else and who do not have a utility bill or a current statement with their current address. There is a need for some clarity about how people can be accommodated in this situation.

- Inaccessible customer care – many have been reporting that they can’t get through to speak to a person on the phone or in a branch. This is a particular source of frustration for people as they feel that once they do get to talk to someone the default position is to advise them to go online. There is a need for an age friendly dedicated team to support the transition

- Concern that products are not matched – people are concerned that the products they enjoy in their current bank may not be matched by other banks such as deposit income security, free from banking charges, savings accounts and access to a credit card because many may have secured the card when working and had an income stream which they don’t as they are now retired. There is a need for clear information from one source that compares products and services so people can make an informed choice. There is a need for clarity on arrangements in place for continued access to credit.

We participated in the Irish Financial Services Union webinar exloring the issues and identifying solutions to address barriers for older people in accessing financial services. You can watch back via the link below: